If you’re a landlord, unexpected repair costs for your property’s essential systems can quickly eat into your profits. Equipment breakdown coverage helps you avoid these financial hits by covering sudden and accidental breakdowns of critical systems and appliances in your rental property.

Unlike standard landlord insurance, which protects against external threats like fire or storms, equipment breakdown insurance steps in when your property’s vital systems fail due to internal issues like power surges, electrical shorts, or mechanical breakdowns.

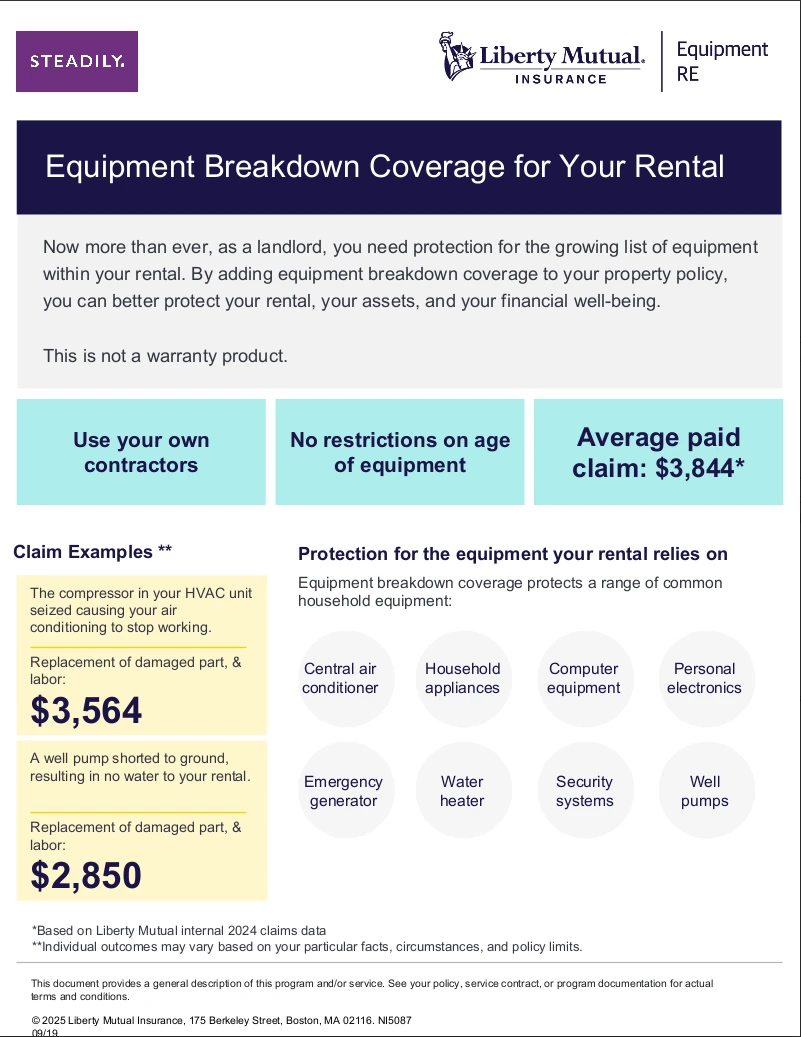

This isn’t a home warranty. It’s true insurance coverage designed to protect your investment when key systems unexpectedly stop working.

What Does Equipment Breakdown Coverage Typically Cover?

For landlords, equipment breakdown coverage can be a financial lifesaver when the following types of equipment need to be unexpectedly repaired or replaced:

- HVAC systems (heating, ventilation, and air conditioning)

- Water heaters and boilers

- Electrical panels, wiring, and circuit breakers

- Refrigerators, freezers, and landlord-owned appliances

- Smart home devices, thermostats, and security systems

- Well pumps and emergency generators

Real-World Examples of Covered Claims

To put it in perspective, here’s how equipment breakdown coverage might save you thousands:

- A compressor seizes in your rental’s HVAC unit during a Texas heatwave. Repairing and replacing damaged parts costs over $3,500.

- A well pump shorts to ground in a rural rental property, leaving tenants without water. Total replacement and labor exceed $2,800.

- An artificial power surge fries your smart thermostat and security system. Coverage steps in to replace them quickly.

A single breakdown can create significant expenses for landlords – but the right insurance can save thousands.

What Isn’t Covered by Equipment Breakdown Insurance?

It’s important to understand what this coverage doesn’t protect against:

- Normal wear and tear or lack of maintenance

- Cosmetic issues or non-mechanical breakdowns

- Tenant-owned appliances or electronics

- Damage from natural disasters (covered under standard landlord insurance)

Think of equipment breakdown coverage as protection against sudden, unexpected breakdowns—not gradual aging or misuse.

How Is This Different From Homeowners Insurance?

If you’re familiar with homeowners insurance, you might wonder how equipment breakdown coverage applies to rentals. Here’s the difference:

Homeowners insurance is designed for owner-occupied properties and does not include protections like loss of rental income if systems fail. Landlord insurance with equipment breakdown coverage, on the other hand, focuses on systems and appliances you provide to tenants and can help you recover lost rental income if the property becomes uninhabitable.

This distinction matters for landlords who need to keep tenants satisfied and protect their cash flow.

Do Landlords Need Equipment Breakdown Coverage?

Modern rental properties rely heavily on complex systems. HVAC units, smart home devices, and electrical panels are more vulnerable than ever to surges and mechanical breakdowns.

Without coverage, a single repair could cost thousands—plus lost rental income if tenants can’t stay during repairs. Equipment breakdown insurance fills this gap and helps landlords avoid financial strain.

Key Benefits of Equipment Breakdown Coverage for Landlords

- Protect your investment from costly system repairs or replacements

- Preserve rental income if a covered breakdown makes the property uninhabitable

- Keep tenants comfortable and avoid long vacancies

- Cover modern systems like smart home devices, solar panel systems and backup generators

Why Choose Steadily for Equipment Breakdown Insurance?

At Steadily, we’re designing landlord insurance policies for the real world. Our equipment breakdown coverage is built specifically for rental properties and includes protections landlords actually need.

Whether you own a single-family rental in Florida or a duplex in California, we help you keep your property running smoothly.

Get a landlord insurance quote today and protect your property from unexpected mechanical and electrical breakdowns.

Frequently Asked Questions

Does equipment breakdown coverage include tenant-owned appliances?

No. It only covers systems and appliances you provide as the landlord.

Is equipment breakdown the same as a home warranty?

No. Home warranties are service contracts with restrictions. Equipment breakdown coverage is true insurance for sudden breakdowns.

What’s the average claim payout?

Recent data from Liberty Mutual's shows that the average paid claim for an equipment breakdown is $3,844.

Do I need this if I have a new property?

Yes. Newer systems can still break down due to power surges or mechanical issues.

Final Thoughts

Equipment breakdown coverage helps landlords avoid costly surprises and keep tenants happy. It’s not just about protecting your property—it’s about protecting your rental income and your peace of mind.

Get a quote from Steadily and find out how fast, affordable coverage can safeguard your rentals.

.png)

.jpg)

.jpg)

.png)