As a landlord, you know unexpected repairs can threaten your rental income and strain your budget. But what about the buried utility lines running beneath your property?

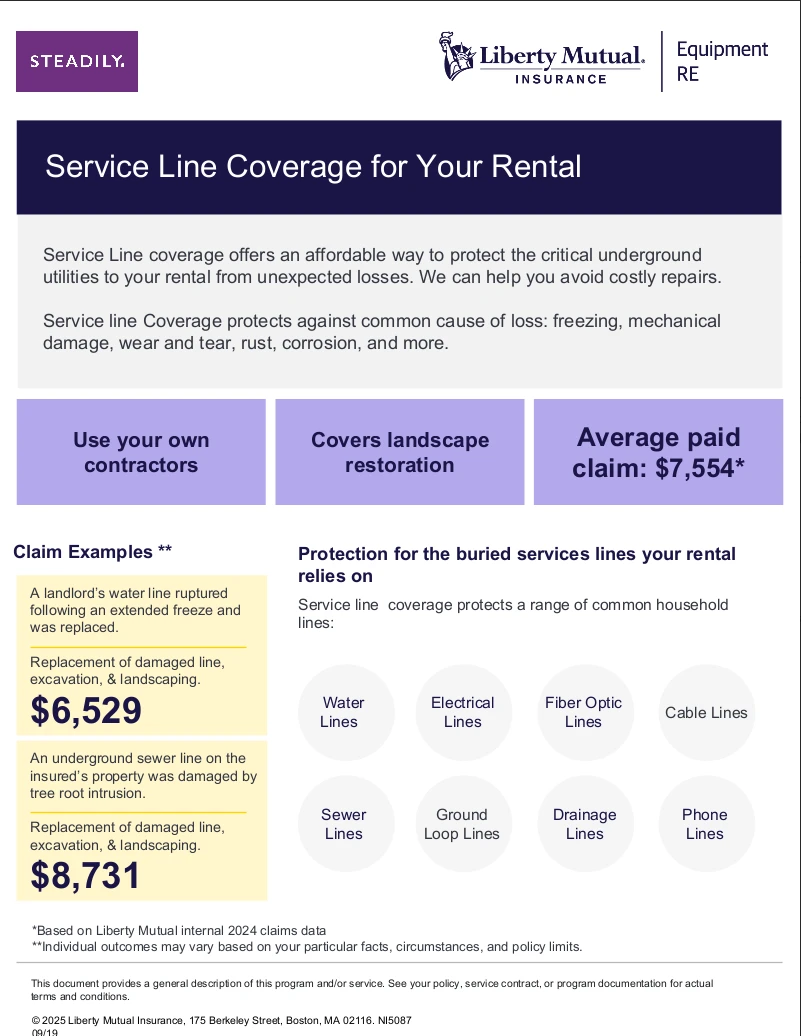

Service line coverage protects you when underground utility lines—like water, sewer, or electrical—are damaged by causes such as freezing, tree root intrusion, or corrosion. This coverage helps pay for repairs, excavation, and even landscape restoration.

Unlike standard landlord insurance, which focuses on above-ground risks like fire or vandalism, service line coverage steps in for hidden, costly failures underground.

For example, Liberty Mutual data shows the average service line claim is $7,554, with incidents ranging from ruptured water lines after a freeze to sewer pipes damaged by tree roots.

What does service line coverage include?

This type of coverage typically protects the following lines on your rental property:

- Water and sewer lines

- Electrical service lines

- Fiber optic, cable, and phone lines

- Drainage and ground loop lines

Covered perils may include:

- Freezing

- Mechanical damage from excavation accidents

- Tree root intrusion

- Wear and tear

- Rust and corrosion

Real-world examples of covered claims

- A water line ruptures after an extended freeze. Total replacement, excavation, and landscaping: $6,529.

- A sewer line is damaged by invasive tree roots. Cost to repair and restore the property: $8,731.

These aren’t rare events—especially in states like Texas, Florida, and California, where extreme weather, aging infrastructure, and high growth make underground utility failures increasingly common.

What isn’t covered?

While service line coverage offers robust protection, it typically excludes:

- Damage beyond your property line (covered by utility companies – in most cases service extends to where it connects with the utility service. Check your policy for specifics)

- Pre-existing damage or gradual deterioration known before purchasing the policy

- Septic systems and wells (unless specified in the policy – lines to these services often covered)

- Tenant-owned equipment or systems

It’s important to check your policy for exact details.

Homeowners vs. landlord insurance: What’s the difference?

Service line coverage exists in both homeowners and landlord insurance, but there are key differences:

Focus of coverage

- Homeowners insurance protects owner-occupied properties and may include service lines used by the resident.

- Landlord insurance focuses on rental properties and includes service lines critical to tenant habitability.

Loss of use vs. loss of rent

- Homeowners policies may provide “loss of use” coverage if the home is uninhabitable.

- Landlord policies often offer “loss of rental income” protection during covered repairs.

Appliance ownership

- Homeowners coverage may extend to all systems within the home.

- Landlord coverage applies only to landlord-owned systems and services provided to tenants.

This distinction is vital because rental properties often rely on heavier utility use and may involve larger systems.

Is service line coverage worth it?

For landlords, the answer is often yes—especially if:

- You want to avoid paying out-of-pocket for excavation, line replacement, and landscape restoration

- Your property is in a region prone to freezes or tree root intrusion

- The property is older, with aging utility lines

A single incident can cost thousands. Service line coverage helps you manage these risks and maintain tenant satisfaction without disrupting cash flow.

Why landlords should consider service line coverage

Service line failures are one of the most overlooked risks for landlords. A broken water or sewer line can render your rental uninhabitable, lead to tenant complaints, and delay income.

At Steadily, we’re building landlord policies designed for real-world risks. That includes offering endorsements like service line coverage alongside equipment breakdown coverage, vandalism and burglary protection, and more.

Frequently asked questions

Does service line coverage include damage to city-owned lines?

No. It covers service lines that you’re responsible for on your property, not those owned by utility companies.

Are landscape restoration costs included?

Yes. Most policies pay for restoring your yard after excavation and repairs.

Is this coverage included in a standard landlord policy?

Not always. It’s typically an optional endorsement you can add to your policy.

What’s the average cost of a service line repair?

According to Liberty Mutual, the average claim is over $7,500, but costs can exceed $10,000 in some cases.

Do I need service line coverage for a newer rental property?

Even newer properties aren’t immune to service line failure. Coverage is still recommended.

Final thoughts

Service line coverage gives landlords peace of mind for one of the most expensive and disruptive risks on a rental property. From frozen pipes to invasive tree roots, this protection helps you avoid out-of-pocket repairs and keep tenants happy.

Get a landlord insurance quote from Steadily to see how affordable it is to add service line coverage to your policy.

.png)

.jpg)

.jpg)

.png)